Related articles

Will Shiba Inu Coin Hit $1 in 2024?2024-12-12 17:32:53The price of Shiba Inu might rise in 2024, similar to X […]

PropiChain (PCHAIN) Coin Review & Analysis: Next Big 12,000x RWA Altcoin?2024-12-12 17:10:33Fueled by Donald Trump’s big victory in the US electio […]

5 Best Crypto Staking Platforms in 20242024-12-12 16:34:15A lot of newcomers believe that trading cryptocurrency […]

SpacePay (SPY) Coin Review & Analysis: Next Big Altcoin Of 2024?2024-12-12 16:20:20Fueled by Donald Trump’s big victory in the US electio […]

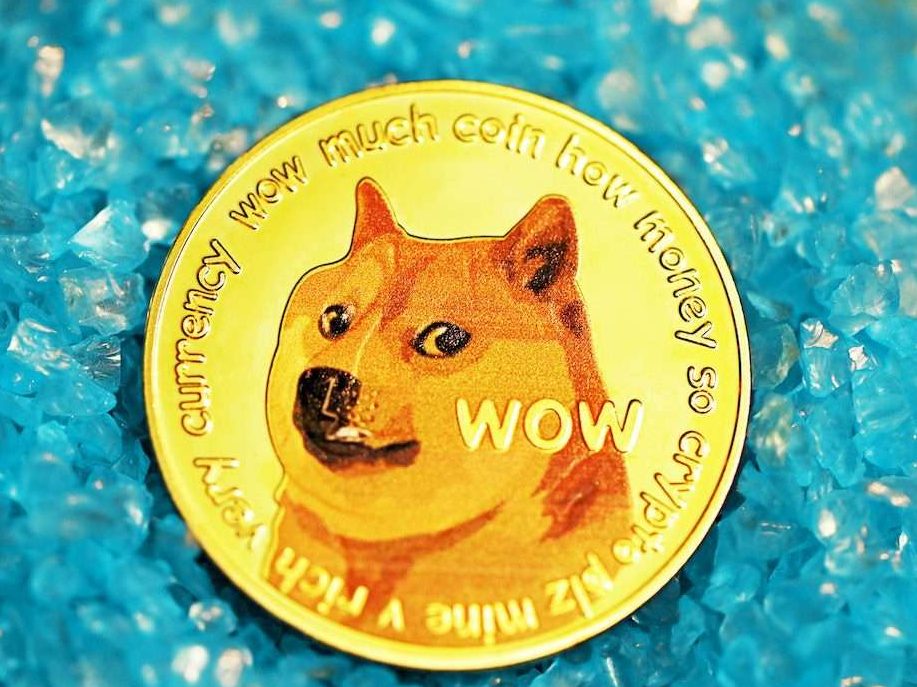

Dogen ($DOGEN) Meme Coin Review & Analysis: Next 100X Meme Coin On Solana?2024-12-12 16:00:14Followed Donald Trump’s big victory in US election on N […]